WORKING CAPITAL LOAN

All Types Of Working Capital LoanRunning short of money to manage your day to day business operations?

Avail collateral free working capital loan from Rupiyamart’s banking partners. We solves your cash flow challenges by financing your business growth through instant settlements and quick business loans.

- Guaranteed fast disbursals of loan in no time.

- Installments can pe paid on daily, weekly and monthly basis.

- Offers other services like cash credit, bank overdraft, letter of credit, bill discounting with minimum interest rates.

- Gives you best loan options with low interest rate.

Loans

Check your latest cibil score instantly

online and get access to the list of

preapproved loans

Free & unlimited access

Get free & unlimited access to your

complete credit information report. Analyse

your credit history & improve your cibil

score.

Check Experian Score 24×7

Check your Experian credit score 24X7.

Protect yourself against identity thefts, bank

reporting errors & poor credit rating.

Q1 WHAT IS WORKING CAPITAL LOAN ?

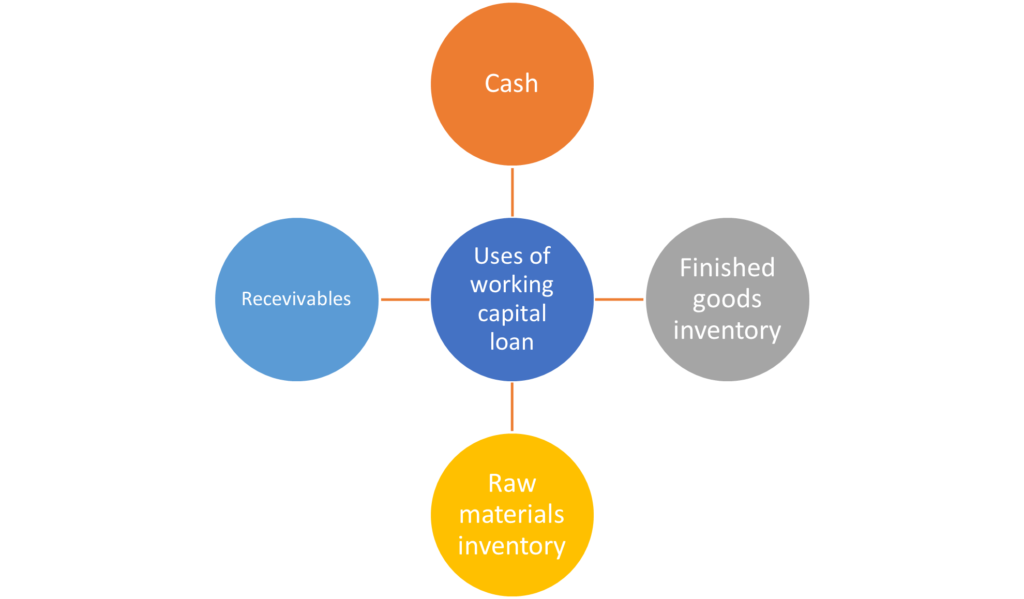

A Working Capital Loan is one that is availed of to fund the day-to-day operations of a business, ranging from payment of employees’ wages to covering accounts payable.

Q2 WHY IT IS NEEDED?

A Working Capital Loan Is used for payment of monthly overheads to day-to-day expenses, purchase of raw materials, and inventory management.

Q3 WHAT IS TENURE OF LOAN ?

A Working Capital Loan is primarily applicable for small and medium enterprises, and usually come with a loan tenure ranging from anywhere between 6-48 months.

Q4 HOW MUCH LOAN AMOUNT CAN I AVAIL?

Loan Amount: The loan amount offered via a Working Capital Loan depends on the business requirements, business experience and tenure. It varies and is customised to meet the particular financial needs of the business.

Q5 IS THERE COLLATERAAL NEEDED FOR LOAN?

Collateral : Working Capital Loans can be either secured or unsecured, i.e., you may or may not be required to pledge a collateral to avail of the loan. The options of collateral range from property, securities, gold, investments or the business itself. The bank curates the Working Capital Loan as per the collateral capability of the borrower. While in case of unsecured Working Capital Loans, lenders take a look at your personal financial statements, credit score and tax returns, to determine your eligibility.

WHAT IS THE ELIGIBILITY?

Age Criteria: Another factor is the age criteria to apply for a loan. The borrower should be above the age of 21 years and below the age of 65 years.

Q7 WHO CAN APPLY FOR LAON?

Loan Applicability: You can apply for a Working Capital Loan if you are an entrepreneur, private or public company, partnership firm, sole proprietor, MSME, self-employed professional or non-professional.